The AI Bubble And What It Means for The Workplace

Is AI a trillion-dollar gamble that underestimates what humans actually do at work?

When Softbank sells its entire Nvidia holding (Silicon Republic, 2025), JP Morgan’s Jamie Dimon warns that tech stocks are overheated, and Jeff Bezos admits there’s an AI bubble, perhaps we should pay attention. That said, Big Tech firms are collectively spending nearly $400 billion on AI infrastructure this year alone (NPR, 2025), 30% of European workers now use AI daily according to the European Commission Joint Research Centre (2025), and US workplace AI usage rose from 40% to 45% between Q2 and Q3 2025 (Gallup, 2025). At the same time, Irish workers seem reluctant to adopt AI tools at work. According to PwC, only 10% of Irish workers use AI tools daily versus 14% globally. Adoption rates tell a mixed story. So are we witnessing genuine workplace transformation, or a cycle of speculation that will inevitably collapse leaving ordinary working people out of work and out of pocket?

Bubbles Too Easily Forgotten

Remember the last speculative bubble? If you were around when it popped in 2008/9, you’ll know what comes with a collapse. It was a bizarre time. All of a sudden, the roads were empty and the airports were full. Construction equipment filled auction yards while jobs disappeared like fairy dust. Some people handed keys to their houses back to the banks and left. Others who couldn’t cope were found on the end of ropes. It took until early 2010 for the penny to drop for me, when one by one, I let my staff go and closed the doors. I regard myself as one of the fortunate ones, though.

We were collectively consumed by the hype machine, convinced that the party would never end. This time, I get the same uncomfortable feeling. The gap between reality and fiction has widened. Just look at the numbers – Goldman Sachs estimates AI capital expenditure will reach $390 billion this year. AI-related stocks have contributed 75% of the S&P 500’s returns and 90% of capital spending growth since ChatGPT launched in 2022 (Cingari, 2025). The heads of JP Morgan, Morgan Stanley, Goldman Sachs, and The Bank of England have all warned of an impending correction (RTE News, 2025). Even technology tycoon Jeff Bozo is warning us there’s a bubble. When beneficiaries of a boom start hedging their bets, or moving to the other side altogether, maybe we should take heed.

While market analysts debate whether there’s a bubble or not, the European Commission has adopted two AI strategies this year to accelerate AI adoption (Integrin, 2025). The AI Continent Action Plan outlines the EU’s goal to be a global leader in Artificial Intelligence. In addition, a report by the EU Commission says that more than a quarter of European adults are already experimenting with AI at work (European Commission Joint Research Centre, 2025). Implementation powers ahead, it seems, despite market risk. At a micro level, I see strong interest amongst businesses to train their people. A business AI program I put together with a colleague in 2023 continues to sell out every time we run it. We’re into our eighth cohort as of January 2026. So, while we stress whether our pension pot will survive the AI boom, on the ground at least, there is an appetite for learning AI.

The Circular Investment Problem

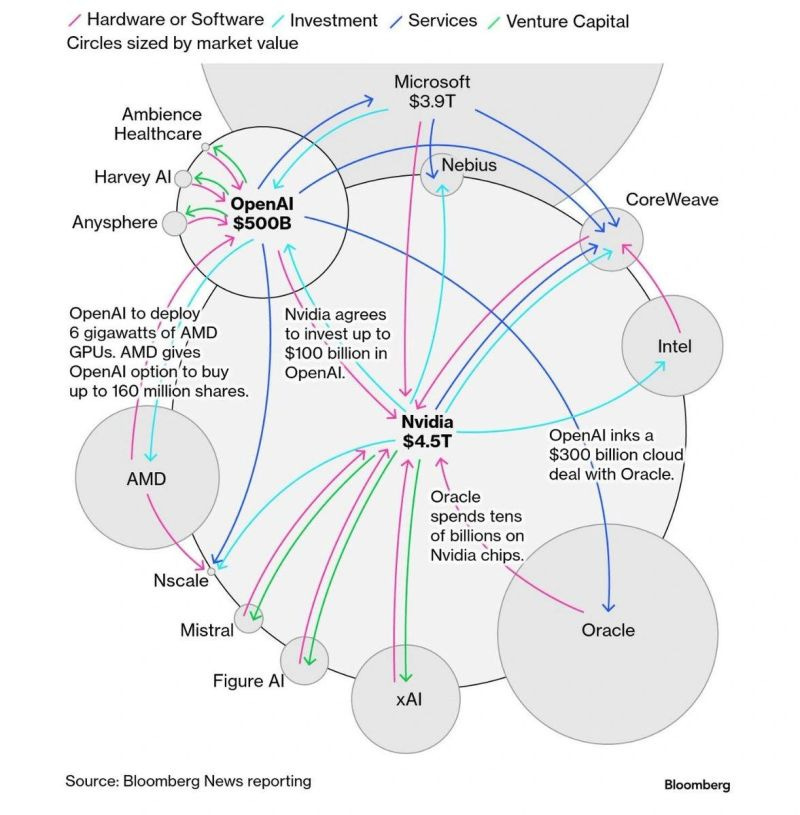

Part of what’s fuelling AI concerns is the tight circular nature of AI investments. For example, Microsoft’s valuation has been rising on belief that OpenAI will become profitable despite it being deep in the hole, and at the same time, hedging its bets with Anthropic (Microsoft, 2025). Nvidia’s revenue boom stems from the broader scramble to build AI infrastructure. Enter Larry Ellison’s Oracle, who has borrowed up to its oxters ($300 billion according to Bloomberg) betting that data centre leasing will double the value of his company. The big players are investing in the smaller players, who are handing it back to the bigger players and everyone is excited about everyone’s growth. When you look at who’s funding who, you can see that all this growth looks like financial incest.

Side note here: As it is with most CEOs, Ellison is hyper-competitive, perhaps even a little psychopathic. Not to mention an ethically questionable business history. He makes big, bold bets and his AI move looks like it’s cracking at the seams (Oracle down 44% since September). Oracle might be one of the first to blow up, and if it does, it may take the whole AI game down with it.

Compare this gap between debt and profitability to the dot-com bubble. The top tech companies of the time traded at 70 times forward earnings in 2000. Today’s AI giants sit around 26 times earnings (iShares, 2025). Not exactly cheap, but maybe not the same inflated valuation. The difference, AI evangelists argue, is that today’s Big Tech generates real revenue from real customers albeit not where it needs to be. PE, however, is only one metric and not enough in itself to calm my nerves.

Profitability and productivity aren’t the same thing either. AI might be profitable for Nvidia at the moment without necessarily being productive for organisations buying it. Research from MIT earlier this year found that 95% of businesses implementing AI reported zero measurable value (MIT Technology Review, 2025). That should raise eyebrows. An Upwork study found AI agents from OpenAI, Google DeepMind, and Anthropic failed to complete many straightforward workplace tasks autonomously. Even Ilya Sutskever, former chief scientist at OpenAI, now highlights that large language models aren’t the pathway to artificial general intelligence many assumed. While the money flows around in tight-knit circles, the productivity gains they promised seem to remain elusive, at least for now.

What’s Happening at Work

From what I see training business people and educators on AI, whether or not stocks are overvalued is somewhat irrelevant. I work at the intersection of people and technology, and I see an appetite for leaning generative AI, to improve workflows and create efficiencies. And I believe that Gen AI is capable of delivering on that if people know how to use it, if they can develop a particular structural way of thinking. The hype machine suggests that you just type a one-shot or two-shot prompt into ChatGPT or Claude and your problem is solved, but that’s not how it works. To get the best from AI tools requires strategic thought and ability to see where the gaps are. The AI needs humans to give it structure and direction, otherwise it gives you inaccuracies at best, gibberish at worst.

Even if this bubble bursts, the genie isn’t going back in the bottle. Much like the internet in the 2000s, this technology isn’t going away, in my opinion. These tools are good, if we can accept that people are the key to digital transformation, not the technology itself. The tech is agnostic, it’s how organisations test, plan, train, and implement that will ultimately count. The businesses that get this right will thrive regardless what the markets do.

If investment flows into learning and development, up-skilling workers and digitally transforming workplaces, then a correction might hurt investors without devastating workplaces. But if spending is primarily speculative, chasing short-term returns through cost-cutting automation, the bursting bubble could leave organisations with expensive technology and a workforce that’s been deskilled or displaced. Critical thinking and decision making outsourced to statistical predictive machines that can’t imagine, feel, empathise or interpret the real world will be the real catastrophe. As Gerald C. Kane wrote in The Technology Fallacy (2019), digital transformation is fundamentally about people, not technology.

Where Do We Go From Here?

The bubble question is fundamentally for investors, but valid for ordinary people too, nonetheless, given its potential impact on jobs and the future of work. For those of us down in the trenches getting our hands dirty, the questions are a little different. Change is inevitable, so are we willing to learn new ways of working? What kind of work do we value and want to preserve? Which tasks are we relieved to delegate to an AI?

McKinsey estimates AI automation could unlock $2.9 trillion in US economic value by 2030 (McKinsey Global Institute, 2025). But value for whom? Distributed how? Will we realise more time to do things we actually enjoy? Nobody will accept a lower standard of living, especially given the ongoing erosion of real wages – there’s only so much ordinary people will endure before they fight back.

The danger isn’t artificial intelligence itself. The danger is treating a socio-technical transformation as merely a financial opportunity. Bubbles come and go, but what work means to us beyond productivity continues to matter. Productivity for productivity’s sake is a farce. It allows organisations to think of people as machines, objects to be manipulated and, perhaps, even be replaced altogether. Whether this bubble bursts or deflates gradually, the real work is building systems that treat humans as more than resources to be optimised for shareholder benefit.

🎓 Learn AI For Work

I’m not talking about creating avatars for social media, writing emails, making stupid cat pictures, generating a muffin recipe, or having ChatGPT write your essay for college...I’m talking real AI Skills. Ones that allow you create something that solves a problem, or speeds up a workflow. You can develop the skills to do your work faster and have more time for yourself. Put money in your pocket and claw back your time. Learn GenAI Skills.